Utilising Machine Learning to Optimise Financial Reporting and Compliance in Sap

Keywords:

Financial Reporting, Machine Learning, Compliance, SAP Systems, Predictive Analytics.Abstract

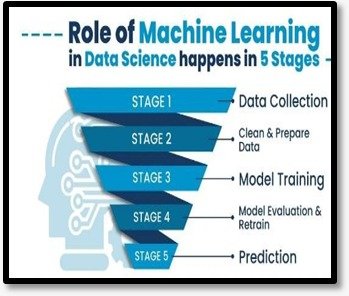

The research investigates the role of machine learning in ensuring the optimization of financial reporting, compliance, and risk management within SAP systems. It looks at the way machine learning enhances data categorization, predictive analytics, and fraud detection for more accurate financial forecasting and efficient operations. Machine learning analyzes vast amounts of data in real time for proactive insights, with a guarantee of compliance with ever-evolving regulations. The study has also identified various advantages of machine learning in lessening errors, improving decision-making, and strengthening the overall financial integrity. This also means the use of machine learning on SAP systems pays off considerably while developing financial operations.

Downloads

References

1. Rane, N.L., Choudhary, S.P. and Rane, J., 2024. Artificial Intelligence-driven corporate finance: enhancing efficiency and decision-making through machine learning, natural Language processing, and robotic Process automation in corporate governance and sustainability. Studies in Economics and Business Relations, 5(2), pp.1-22.

2. Sarker, I.H., 2023. Machine learning for intelligent data analysis and automation in cybersecurity: current and prospects. Annals of Data Science, 10(6), pp.1473-1498.

3. Bammidi, T.R., Gutta, L.M., Kotagiri, A., Samayamantri, L.S. and krishnaVaddy, R., 2024. The Crucial Role of Data Quality in Automated Decision-Making Systems. International Journal of Management Education for Sustainable Development, 7(7), pp.1-22.

4. Zhao, L., Yang, M.M., Wang, Z. and Michelson, G., 2023. Trends in the dynamic evolution of corporate social responsibility and leadership: A literature review and bibliometric analysis. Journal of Business Ethics, 182(1), pp.135-157.

5. Kovur, K.M., Gedela, M. and Rao, A.M., 2023. Financial Risk Assessment using Machine Learning Engineering (FRAME): Scenario-based Quantitative Analysis under Uncertainty. International Journal of Automation, Artificial Intelligence and Machine Learning, 3(1), pp.1-13.

6. Paramesha, M., Rane, N.L. and Rane, J., 2024. Big data analytics, artificial intelligence, machine learning, internet of things, and blockchain for enhanced business intelligence. Partners Universal Multidisciplinary Research Journal, 1(2), pp.110-133.

7. Bello, O.A. and Olufemi, K., 2024. Artificial intelligence in fraud prevention: Exploring techniques and applications challenges and opportunities. Computer Science & IT Research Journal, 5(6), pp.1505-1520.

8. Javaid, H.A., 2024. Improving Fraud Detection and Risk Assessment in Financial Service using Predictive Analytics and Data Mining. Integrated Journal of Science and Technology, 1(8).

9. Ganapathy, V., 2023. AI in auditing: A comprehensive review of applications, benefits, and challenges. Shodh Sari-An International Multidisciplinary Journal, 2(4), pp.328-343.

10. Ramstead, M.J., Seth, A.K., Hesp, C., Sandved-Smith, L., Mago, J., Lifshitz, M., Pagnoni, G., Smith, R., Dumas, G., Lutz, A. and Friston, K., 2022. From generative models to generative passages: a computational approach to (neuro) phenomenology. Review of Philosophy and Psychology, 13(4), pp.829-857.

11. Tan, E., Jean, M.P., Simonofski, A., Tombal, T., Kleizen, B., Sabbe, M., Bechoux, L. and Willem, P., 2023. Artificial intelligence and algorithmic decisions in fraud detection: An interpretive structural model. Data & policy, 5, p.e25.

12. Christou, P.A., 2022. How to use thematic analysis in qualitative research. Journal of Qualitative Research in Tourism, 3(2), pp.79-95.

13. Adjabi, I., Ouahabi, A., Benzaoui, A. and Taleb-Ahmed, A., 2020. Past, present, and future of face recognition: A review. Electronics, 9(8), p.1188.

14. Aljohani, A., 2023. Predictive analytics and machine learning for real-time supply chain risk mitigation and agility. Sustainability, 15(20), p.15088.

15. Troin, M., Arsenault, R., Wood, A.W., Brissette, F. and Martel, J.L., 2021. Generating ensemble streamflow forecasts: A review of methods and approaches over the past 40 years.

16. Deekshith, A., 2021. Data engineering for AI: Optimizing data quality and accessibility for machine learning models. International Journal of Management Education for Sustainable Development, 4(4), pp.1-33.

17. Akkiraju, R., Sinha, V., Xu, A., Mahmud, J., Gundecha, P., Liu, Z., Liu, X. and Schumacher, J., 2020. Characterizing machine learning processes: A maturity framework. In Business Process Management: 18th International Conference, BPM 2020, Seville, Spain, September 13–18, 2020, Proceedings 18 (pp. 17-31). Springer International Publishing.

18. Balantrapu, S.S., 2021. The Impact of Machine Learning on Incident Response Strategies. International Journal of Management Education for Sustainable Development, 4(4), pp.1-17.

19. Liu, Z., Ciais, P., Deng, Z., Lei, R., Davis, S.J., Feng, S., Zheng, B., Cui, D., Dou, X., Zhu, B. and Guo, R., 2020. Near-real-time monitoring of global CO2 emissions reveals the effects of the COVID-19 pandemic. Nature communications, 11(1), p.5172.

20. Lee, C.H., Yang, H.C., Wei, Y.C. and Hsu, W.K., 2021. Enabling blockchain based scm systems with a real time event monitoring function for preemptive risk management. Applied Sciences, 11(11), p.4811.

21. Sahu, M.K., 2020. Machine Learning for Anti-Money Laundering (AML) in Banking: Advanced Techniques, Models, and Real-World Case Studies. Journal of Science & Technology, 1(1), pp.384-424.

Published

How to Cite

Issue

Section

Copyright (c) 2025 Poornachandar Pokala

This work is licensed under a Creative Commons Attribution 4.0 International License.